With the current tumultuous events in the Middle East bringing attention to the mounting energy requirements of the emerging economies, in addition to the burgeoning necessities of the recovering developed economies, the fact that demand is outstripping supply appears to be blatantly obvious. All the easy oil and gas has been discovered, recovered, depleted and expended. We are now left with on shore 'fracking' and deep sea drilling which are much more expensive endeavors, ultimately driving the price of a barrel of oil sky-high sooner rather than later. Wake up! Peak Oil is here and oil & gas stocks will soar in 2012.

There is no disputing this scenario. The emerging markets of the globe are just beginning to demand their fair share on top of many other factors. Think of this fact, even with the sad state of the current global economy, we are at $100 a barrel oil. What do you think is going to occur when the economies of the world begin to recover and emerging markets gain viable traction? You can kiss $100 a barrel oil goodbye forever. Please review the current oil & gas market highlights and major oil & gas catalysts followed by a review of seven energy plays for 2012 well positioned to take advantage of the coming oil shortage.

Current Oil & Gas Market Highlights

According to an AP report out Wednesday, the nation's crude oil and gasoline supplies contracted last week per the government. Please review this brief excerpt of the report:

Crude supplies fell by 10.6 million barrels, or 3.2 percent, to 323.6 million barrels, which is 5 percent below year-ago levels, the Energy Department's Energy Information Administration said in its weekly report. Oil prices rose to around $107 a barrel on Wednesday after the European Central Bank's first ever offer of three-year loans to banks raised hopes the euro zone would avert a liquidity crisis and head towards economic recovery.

The supply of limit-free and ultra-cheap cash boosted sentiment across financial markets after banks took up a greater-than-expected 489 billion euros. The ECB's successful tender added to optimism after U.S. housing starts and building permits were shown to have jumped to a 1-1/2 year high in November.

On the supply side, oil investors are worried the escalating tension with Iran over the country's nuclear program may disrupt oil shipments from the world's fifth-largest exporter. That said, Saudi Arabia said it pumped over 10 million bpd in November, its highest in decades, to meet strong consumer demand.

Major Oil & Gas Catalyst

Emerging Market Countries Increasing Stockpiles

According to a recent article in the Wall Street Journal, China and India are making a push to stock up on emergency supplies of oil, an effort that could put upward pressure on oil prices. India's government on Wednesday said it plans to more than triple the size of its planned strategic petroleum reserve over the next decade, expanding it to 132 million barrels by 2020 from current construction of a 39-million-barrel stockpile.

Additionally, recent data showed that China's daily crude imports from Saudi Arabia in November were at the highest levels of the year, which analysts and traders say was partly due to stockpiling for its strategic reserves. China recorded crude imports of almost 1.18 million barrels a day from Saudi Arabia in November, up 32.3% from year-earlier levels.

Kazakhstan Unrest Sparks Worries About 5 Million BPD Production

Clashes in western Kazakhstan spread after the police used arms to suppress unrest in Zhanaozen, where 14 people died in a mass riot on Dec. 16, the worst bout of violence since the former Soviet republic won independence two decades ago. Oil workers at state-owned KazMunaiGaz National Co. units have been striking in Zhanaozen since May over wages, according to a recent BusinessWeek article.

The protests started in the beginning of 2011, the workers demanded higher wages, but their managers refused to make concessions. Another reason for discontent was the arrest of the professional union's lawyer, Natalya Sokolova. The riot against it began in May 2011. The number of protesters reached 18 thousand in June, when they started demanding that the oil production to be under the government's control.

It is unclear why the workers decided to start a violent riot on December 16, when Kazakhstan was celebrating its Independence day. The majority of workers claim though, that the riots were triggered by the authorities.

Middle Eastern Instability

Iran's president vowed to press ahead with the country's nuclear program, causing Israel's Netanyahu to threaten unilateral military action against Iran. The IAEA recently reported it believes Iran is developing a nuclear weapon. Iran in turn threatened to bomb Turkey if Israel takes action. The EU is considering boycotting Iranian oil which will only exacerbate the issue further. If Israel follows through on its statement, you can be sure oil supplies from the region will be bottled-up for some time and the price per barrel will skyrocket. Moreover, a December meeting of OPEC could provide additional negative headlines based on the above conditions as the rift between the members from the last meeting may be aggravated.

Chinese Demand Growth Rising

The spot market for oil is tight. A 16% increase in shipments to China has strained supplies. If any improvements in the geopolitical landscape occur, who knows how high oil could climb? If the spot market is tight with the current conditions across the markets, just imagine how tight it will be when the recovery kicks in to gear.

A recent report by FT detailed the extreme diesel fuel tightness in Asia. The situation is predicted to only get worse. The Chinese are taking steps to increase their share of Middle Eastern oil by entering into a joint venture with state-run Kuwait Petroleum Corp (KPC). Kuwait Petroleum Corp has signed a joint venture deal worth around $9 billion to build an oil refinery and petrochemical plant in southern China, Kuwait's state news agency recently announced. KPC and Sinopec, China's biggest refiner, are equal partners in the project, said the KUNA report.

U.S. Fed and ECB Printing Presses Working Overtime

The FOMC minutes for the two-day November meeting suggest that under current economic circumstances the Federal Reserve will have to engage in a third round of quantitative easing. The solution to the eurozone's sovereign debt issues will inevitably lead to euro printing presses cranking up, allowing them to paper their way out of the problem, which will only devalue the currencies and spur oil prices even higher.

U.S. Economic Indicators Showing Positive Signs Of Recovery

The U.S. housing market, unemployment situation and economic indicators are all showing signs of life. All these signs of improvement bode well for these U.S Energy plays as increased activity will augur demand for the black gold.

Seven Oil Plays For 2012

The following are seven energy plays for 2012: Chesapeake Energy Corporation (CHK), Devon Energy Corporation (DVN), EOG Resources, Inc. (EOG), Halliburton Company (HAL), McMoRan Exploration Co. (MMR), National Oilwell Varco, Inc. (NOV) and Occidental Petroleum Corporation (OXY).

I posit these energy equities will soon soar from their current shares prices based on macroeconomic, sector and company specific catalysts. These stocks have great stories and positive facilitators for future growth. However, many are trading at significant discounts due to incessant negative macroeconomic headlines and a lack of confidence from Main Street based on the ever-present deleterious employment picture. Although recent news regarding the U.S. unemployment picture and housing has been positive, I suggest layering into these names as there may be a significant buying opportunity produced by the bumbling EU bureaucrats as they work their way through the eurzone's sovereign debt debacle.

Current Performance Chart

Click to enlarge images

Charts provided by Scottrade.com.

Company Descriptions and Fundamental Statistics

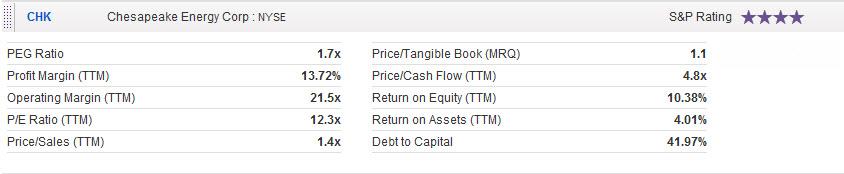

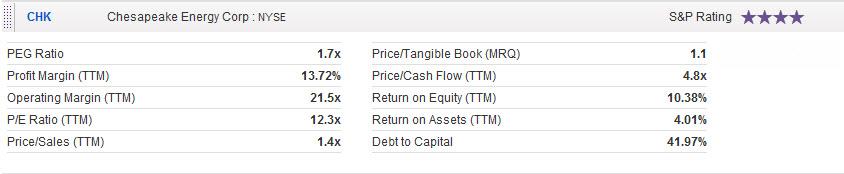

Chesapeake Energy Corporation engages in the acquisition, development, exploration, and production of natural gas and oil properties in the United States.

Fundamental Statistics

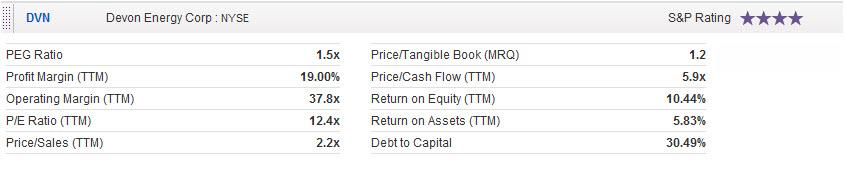

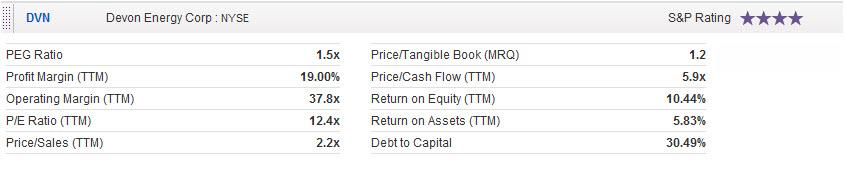

Devon Energy Corporation, together with its subsidiaries, engages in the acquisition, exploration, development, and production of natural gas and oil in the United States and Canada.

Fundamental Statistics

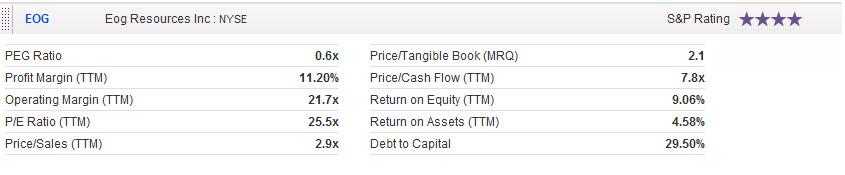

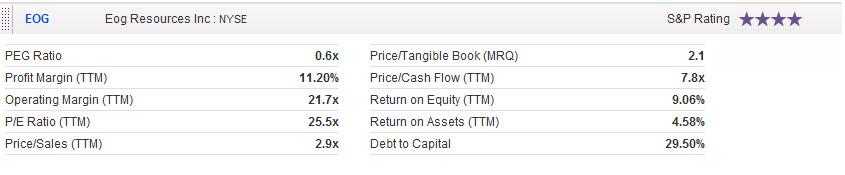

EOG Resources, Inc., together with its subsidiaries, engages in the exploration, development, production, and marketing of natural gas and crude oil primarily in the United States, Canada, the Republic of Trinidad and Tobago, the United Kingdom, and the People's Republic of China.

Fundamental Statistics

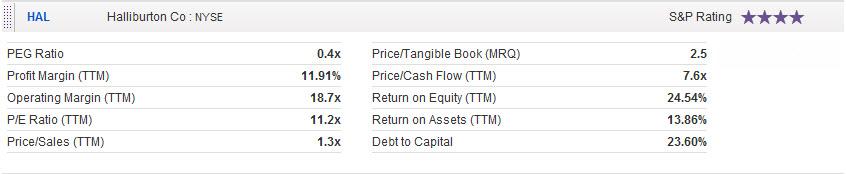

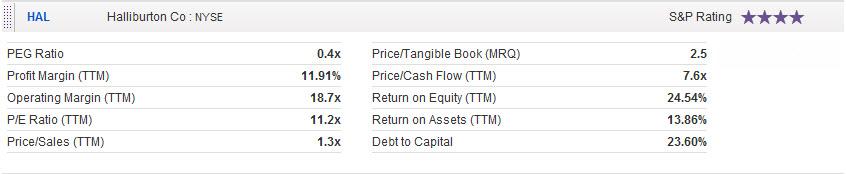

Halliburton Company provides various products and services to the energy industry for the exploration, development, and production of oil and natural gas worldwide.

Fundamental Statistics

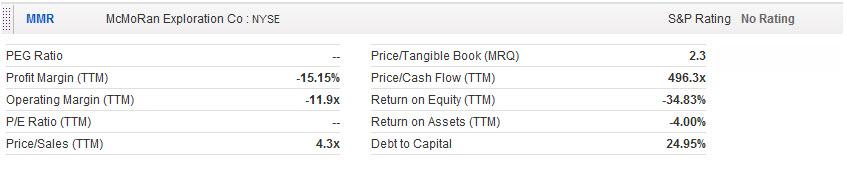

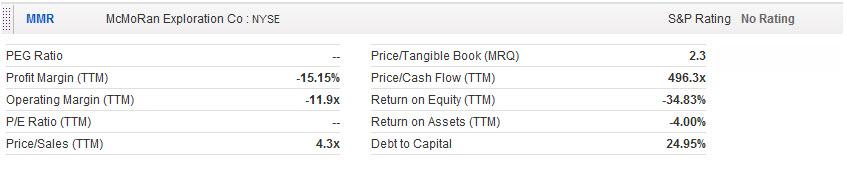

McMoRan Exploration Co., through its subsidiary, McMoRan Oil & Gas LLC, engages in the exploration, development, and production of oil and natural gas offshore in the Gulf of Mexico and onshore in the Gulf Coast area of the United States.

Fundamental Statistics

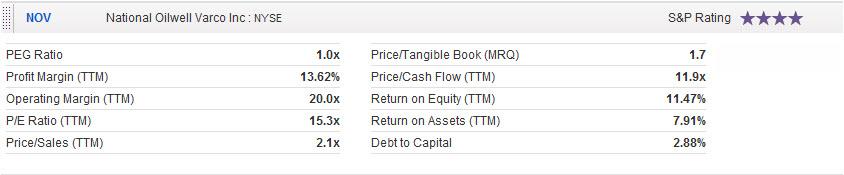

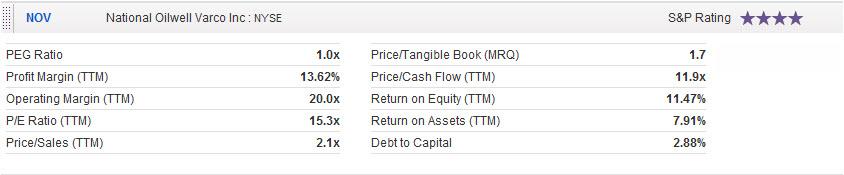

National Oilwell Varco, Inc. designs, constructs, manufactures, and sells systems, components, and products used in oil and gas drilling and production; provides oilfield services and supplies; and distributes products, and provides supply chain integration services to the upstream oil and gas industry worldwide.

Fundamental Statistics

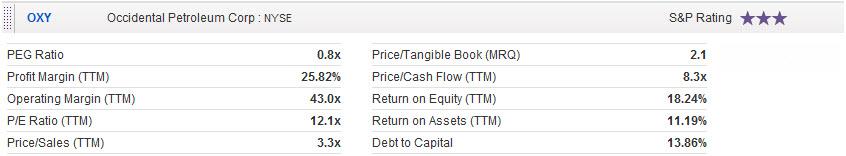

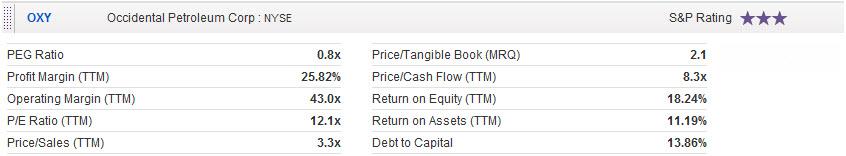

Occidental Petroleum Corporation, together with its subsidiaries, operates as an oil and gas exploration and production company primarily in the United States.

Fundamental Statistics

Conclusion

Based on these facts, the future of companies in the energy industry seems brighter than ever. We all know that past performance is not a surefire indicator of future success. On the other hand, with the finite nature of oil resources and the seeming tipping point of the oil supply/demand equation coming to fruition sooner rather than later, the success of these companies appears certain.

Use this information as a starting point for your own due diligence and research methods before determining whether or not to buy or sell a security.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in CHK, DVN, EOG, HAL, MMR, NOV, OXY over the next 72 hours.

Source: http://seekingalpha.com/article/315482-peak-oil-is-here-energy-stocks-will-soar-in-2012?source=feed

facebook ipo national defense authorization act national defense authorization act clemson seven days in utopia seven days in utopia big 10 championship game

link

link

TaigaCompany

TaigaCompany

etribune

etribune  Bukowsky

Bukowsky